Think your portfolio is diversified? Think again!

KupiX X-rays your portfolio (ETFs & shares) to reveal how you're buying the same mega-cap stocks over and over, exposing you to a hidden concentration risk you didn't know you had.

The False Sense of Security in ETFs

Hidden Overlap

You buy ETFs like VOO, QQQ, and SPY thinking you own three different funds. In reality, you're tripling down on Apple and Microsoft. Your diversification is an illusion that exposes you to a risk you can't see.

Concentration Risk

When these few dominant stocks take a hit, it doesn't just affect a small part of your portfolio—it impacts a massive, disproportionate chunk. A portfolio that seems to hold 500+ companies can dangerously depend on the fate of just 10.

Lack of Clarity & Control

Fund prospectuses are complex and opaque. It's nearly impossible to know your true exposure to each stock, sector, or risk factor. Without this clarity, you don't have real control over your own investments.

Get Total Clarity in 3 Simple Steps

1

Enter Your Portfolio

Simply tell us which ETFs you hold and the percentage of each.

It's simple, fast, and 100% anonymous. We will never ask for your brokerage credentials.

2

We Analyze with Precision

Our engine crunches millions of data points and our AI analyzes company context to give you the full picture from stock overlap to your true exposure to key market factors.

3

Receive Your Smart Report

In minutes, get a professional, easy-to-understand PDF report filled with clear charts.

Uncover your true holdings and take back control of your financial future.

The Product Section (Showcase)

A Single Investment for Total Clarity

Get institutional-grade analysis for less than the cost of a single stock trade

Here is everything included in your KupiX Deep Dive Report

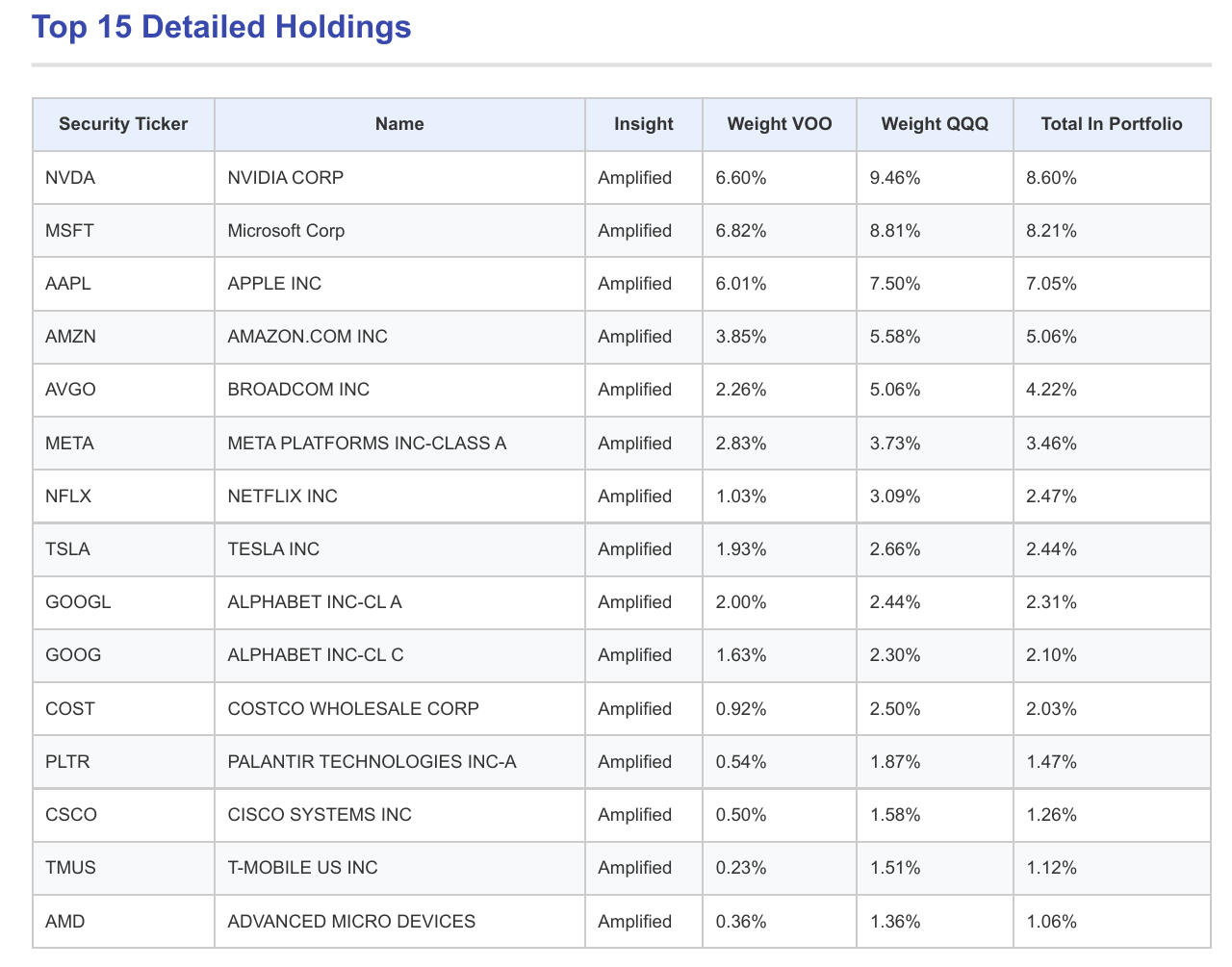

Overlap & Concentration Analysis: Uncover your true, consolidated exposure to every single stock in your portfolio.

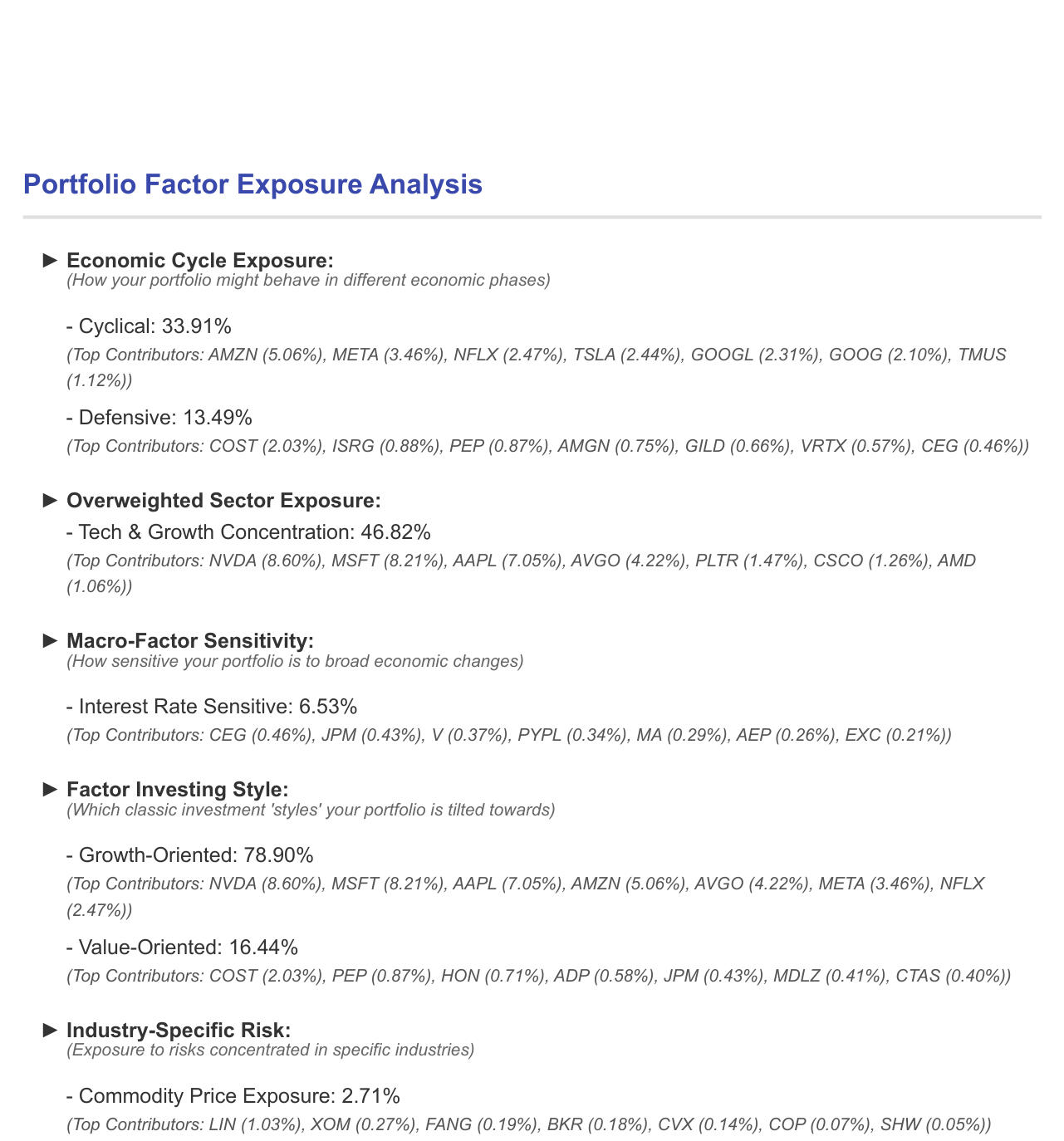

Sector & Industry Breakdown: Go beyond broad labels. See your precise allocation across GICS sectors and dozens of specific industries.

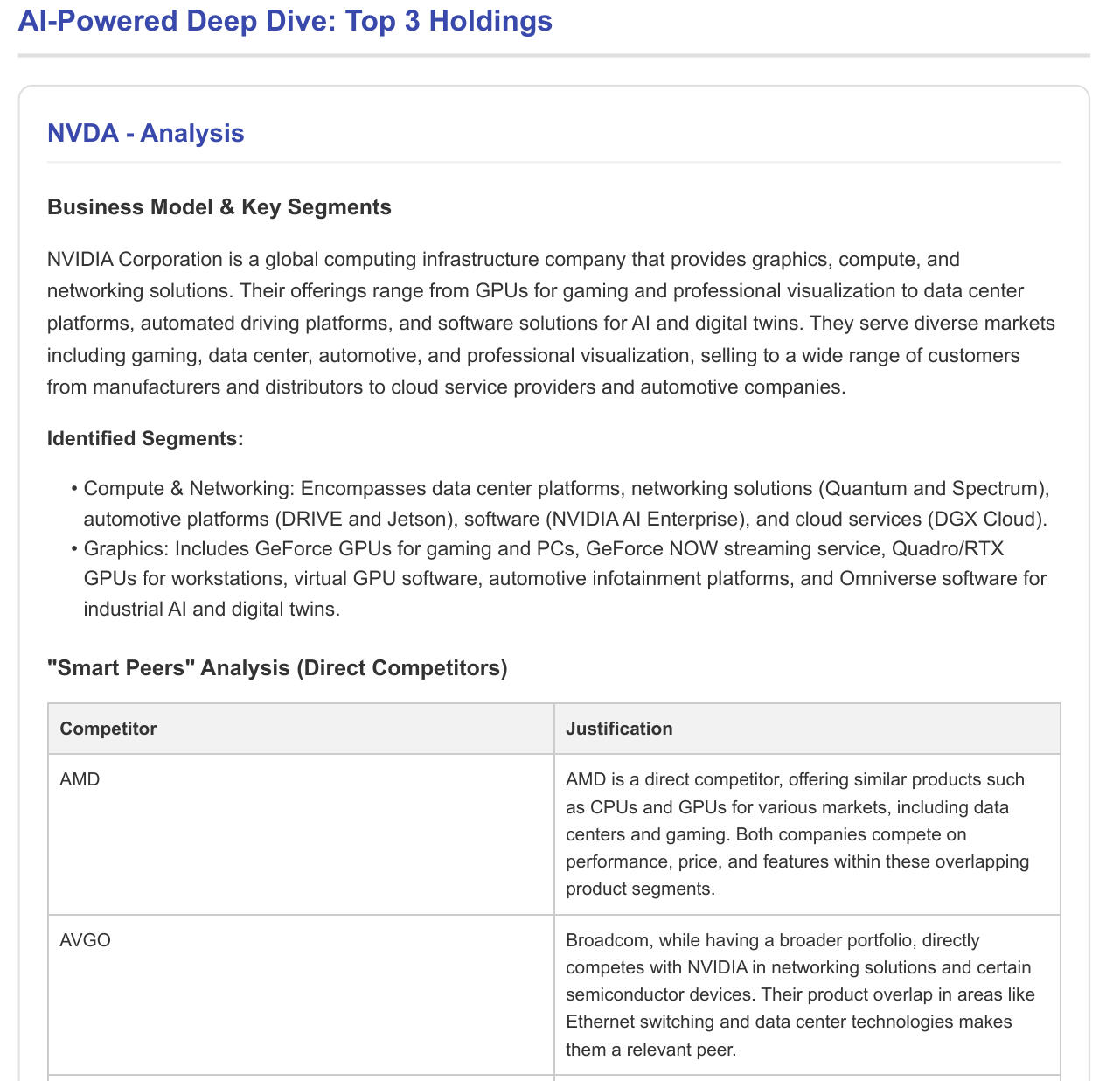

AI-Powered Factor Scoring: Our intelligent engine analyzes each of your top stocks individually to score their exposure to key factors like Cyclicality, Growth, and Value.

"Smart Peers" Competitor Analysis: For your top holdings, our AI identifies their true, direct competitors, providing insights previously unavailable to retail investors.

Instant PDF Report: Receive a clear, multi-page, downloadable document with professional charts and tables for your records.

Frequently Asked Questions.

Q: What ETFs can I analyze on KupiX?

A: KupiX currently provides comprehensive coverage for all ETFs listed on United States exchanges (e.g., VOO, QQQ). We are actively working to expand our coverage to international markets.

Q: Do you need my brokerage login?

A: Absolutely not. We will never ask for your credentials. You simply tell us your tickers and weights.

Q: Is my data secure?

A: Yes. We operate on a 100% anonymous basis and do not store any personal portfolio information after your report is generated.

Q: Is this investment advice?

A: No. KupiX is an informational tool designed to provide clarity and reveal hidden risks. It does not constitute a recommendation to buy or sell any security. Always do your own research.

© 2025 KupiX. All Rights Reserved. | Terms of Service | Privacy Policy | Contact: [email protected]